Medicare Part A

Medicare Part A stands as a crucial component within the extensive framework of the federal government’s health insurance program, designed to cater to the healthcare needs of older adults and other eligible individuals. As one of the four integral parts of Medicare, Part A focuses primarily on providing financial assistance for various healthcare services related to inpatient care. Understanding the nuances of Medicare Part A is essential for beneficiaries to navigate the complexities of healthcare coverage effectively.

Overview of Medicare Part A

Medicare Part A serves as a cornerstone in the broader spectrum of Medicare coverage. Its fundamental role is to alleviate the financial burden associated with specific healthcare services, particularly those related to inpatient care.

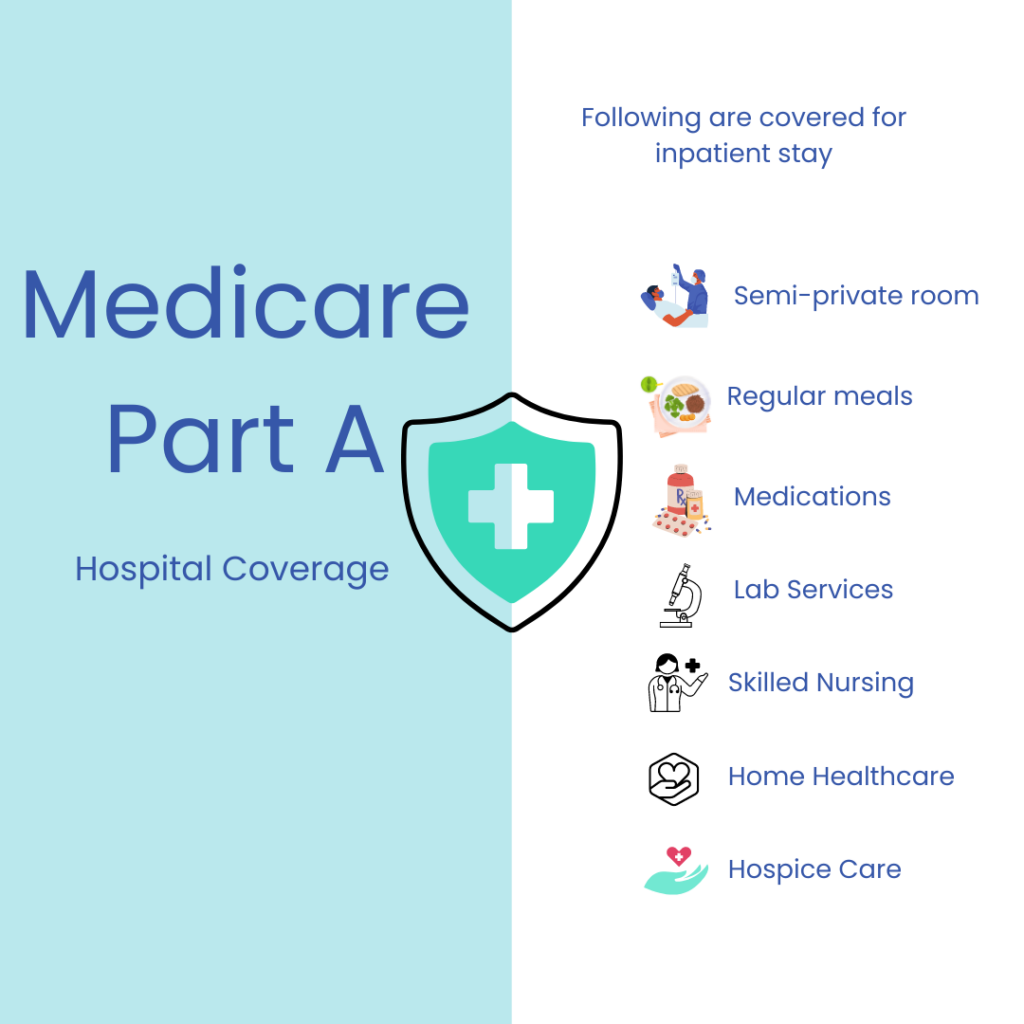

The key areas covered by Medicare Part A include:

- Inpatient Hospital Care: One of the primary aspects of Part A coverage is the provision for inpatient hospital services. This encompasses hospital stays that are deemed necessary based on a doctor's orders. Covered services include semi-private rooms, meals, general nursing, and drugs required for inpatient treatments.

- Skilled Nursing Facility Care: Part A extends its coverage to inpatient care in skilled nursing facilities. This includes expenses related to semi-private rooms, as well as necessary supplies and drugs during the stay.

- Hospice Care: Beneficiaries under Medicare Part A are entitled to coverage for hospice care. This includes a range of services aimed at providing comfort and support to individuals with terminal illnesses and their families.

- Home Health Care: Part A also caters to home health care needs, covering services such as physical and occupational therapy for individuals who are homebound.

Understanding the specific components of coverage is crucial for beneficiaries to make informed decisions about their healthcare needs.

In-Depth Coverage Areas of Medicare Part A

Inpatient Hospital Care

Medicare Part A’s coverage for inpatient hospital care is comprehensive, encompassing a variety of services to ensure the well-being of beneficiaries. When admitted to a hospital on a doctor’s orders, Part A covers semi-private rooms, meals, general nursing, and necessary drugs for inpatient treatments. It is important to note that if a beneficiary opts for care outside Part A’s coverage, such as a private room or a private-duty nurse, they are responsible for covering the incremental costs.

In cases where psychiatric hospitalization for mental health treatment is required, Part A provides coverage, albeit with limitations. Beneficiaries receive coverage for up to 190 days over their lifetime for psychiatric hospital stays. This underscores the importance of understanding the specific terms and limitations associated with mental health coverage under Part A.

Part A extends its coverage across various types of facilities, including acute care hospitals, critical access hospitals, inpatient rehabilitation facilities, inpatient psychiatric facilities, long-term care hospitals, and participation in qualifying clinical research studies.

Skilled Nursing Facility Care

Medicare Part A’s coverage for inpatient care in skilled nursing facilities is designed to address the unique needs of individuals requiring specialized care. This coverage includes expenses related to semi-private rooms, essential supplies, and drugs during the stay. It is crucial for beneficiaries to be aware of the scope of coverage to make informed decisions about their healthcare options.

Hospice Care

Recognizing the importance of compassionate care for individuals with terminal illnesses, Medicare Part A provides coverage for hospice care. This includes a range of services aimed at enhancing the quality of life for beneficiaries and providing support to their families. Services covered under hospice care may include doctor’s services, medications, and grief-and-loss counseling for the families.

Home Health Care

For individuals who are homebound and in need of healthcare services, Medicare Part A extends coverage to home health care. This includes services such as physical and occupational therapy, ensuring that beneficiaries receive the necessary care in the comfort of their homes.

How Much Does Part A Costs?

Is Medicare Part A free?

Well, not exactly. Most beneficiaries will pay nothing for Medicare Part A at age 65, though because they have already pre-paid it. You see, we all pay taxes during our working years that are specifically for our future Medicare hospital coverage during retirement. These taxes go to offset the cost of Part A later on.

As long as you have worked for 10 years in your lifetime in the United States, you will generally pay nothing at all for Part A. If you do not have this work history, you can purchase Part A as long as you have been a legal resident or green card holder for at least 5 years. Read more about the cost of Part A on our Medicare costs page.

If you do not have 40 quarters, you can pay for Part A. Premiums in 2024 are $505 if you have less than 30 quarters or $278 for people with 30 – 39 quarters.

When to Enroll in Medicare Part A

Enrollment in Medicare Part A is an automatic process for individuals already receiving Social Security income benefits. Approximately 2 to 3 months before turning 65, beneficiaries will receive their Medicare card by mail. This distinctive card, adorned in red, white, and blue on heavy card stock, signals their enrollment into Medicare Part A.

It is advisable for beneficiaries to attentively monitor their mail for the arrival of the Medicare card. Upon receipt, laminating the card is acceptable, ensuring its durability and longevity as it resides in wallets or purses.

For those not currently receiving Social Security income benefits or Railroad Retirement income benefits, active enrollment in Medicare Part A is necessary at the age of 65. This can be conveniently completed through the Social Security website.

Medicare Part A Cost-Sharing Details

While Medicare Part A offers substantial coverage, beneficiaries are accountable for certain cost-sharing aspects. Annually, the Centers for Medicare & Medicaid Services (CMS) determines the deductible and coinsurance responsibilities for Medicare Part A coverage in the upcoming year. For the year 2024, beneficiaries can anticipate the following cost-sharing amounts:

- Deductible for Inpatient Hospital Stay:

- $1,632 for each inpatient hospital stay when not admitted in the previous 60 days.

- Coinsurance for Consecutive Hospital Stays:

- $408 per day for days 61 – 90 of a consecutive hospital stay.

- $800 per day for days 91 – 150 of a consecutive hospital stay.

- Lifetime Reserve Days:

- Any and all costs incurred beyond your lifetime reserve days.

Expert Guidance For More Information

Are you seeking help to get clarity on your healthcare coverage choices? Allow our team of experts to guide you in understanding your basic benefits, and then we can assist you in selecting the right supplemental plan. Reach out to us today!

The Medicare program comprises Part A, B, C, and D. It's important to note that Part C, D, and Medigap plans are offered by private insurance carriers, not the federal government.

You can opt for both a Medigap plan and a Part D plan, or you can choose an Advantage plan, only if you are enrolled in in Medicare Part A and Part B.

Have any questions?

Faq Questions

Faq Questions

Have any questions And answers

What is insurance ?

Insurance is a contract between an individual or an organization (the policyholder) and an insurance company, where the policyholder pays a premium in exchange for protection..

What is the purpose of insurance ?

The purpose of insurance is to protect individuals, businesses, and other entities from financial losses due to unexpected events or accidents. Insurance provides a way to transfer the risk of loss..

How does insurance work ?

Insurance works by pooling together the risks of many individuals or organizations and distributing the financial costs of unexpected losses among the members of the pool. Insurance companies..